All companies that go out of business do so for the same reason: they run out of money. — Don Valentine, founder of Sequoia Capital

In 2021, African startups recorded a major milestone of $4.6 billion in funding. Globally, rounds and valuations were skyrocketing. VCs were overflowing with cash.

Until everything suddenly changed.

The decade-long VC summer and free money were over. By Q3 2022, global venture funding had declined by $90 billion (53%). Historically, the last two major recessionary periods were the dot-com crash (2000-2002) and the financial crisis (2008/2009). The Dot-com bubble burst lasted 2-3 years. It was driven by excessive speculation in internet companies, fueled by the bull market of the late 1990s and the abundance of venture capital.

The financial crisis stretched for 2 years. It happened as a result of an asset bubble concentrated in the housing market driven by overly aggressive lending and mortgage. It cratered the U.S. economy; by extension - it affected the global economy.

This time, it is different.

VC Winter: What, How, Why?

It all started after the global pandemic. The aftermath of the pandemic hurt the U.S. economy. In November 2021, inflation spiked to 6.8% from 4.7% — for the first time in forty years. Toward the end of 2022, inflation had reached 8%.

From the image below, the Federal Reserve (the U.S. Central Bank) has historically used interest rates to tame inflation. But they dropped the ball. The CPI (read: inflation, the trend in red) had gone wildly out of sync with the Federal Reserve’s rates (interest, the trend in purple). the Federal Reserves waited too long before they reacted to raging inflation.

Source: Wolfstreet, BLS, Federal Reserves

As a result, to reduce inflation, the Federal Reserve suddenly increased the interest rate to match the pace of inflation — inflation and interest rates have a direct relationship. They tend to move in the same direction.

How does this affect the market and VCs?

Interest rate is to asset price (stocks) what gravity is to the apple. — Warren Buffet

When the interest rate is high, there is a very high gravitational pull on asset prices.

Interest rates and stock prices move in the opposite direction. All stocks get hurt by rising interest rates. When interest rates increased, by extension, U.S. bonds (a low-risk investment) became relatively attractive.

This is indicative of the reaction of the market (as shown in the image below) when the Federal Reserve bumped interest rates.

Source: MacroMicro; S&P 500 index vs US 10-year Treasury Bond yield

In simple terms: long-dated stocks that have their earnings and revenue in the distant future got hurt the most because the higher interest rate means that those future earnings of revenue get discounted down to a lower number today.

What happened in the public market snowballed into a mighty avalanche that ushered us into the VC winter: valuation reset. The initial reaction: the total amount of venture capital raised fell off a cliff at the series stage. Series B valuations were cut in half.

At the Series C stage, valuations dropped by 75%. At Series D 85%. For the first time in a very long time, unicorns became rare. However, at the earliest stages of investing, investment activities continued despite the general revaluations.

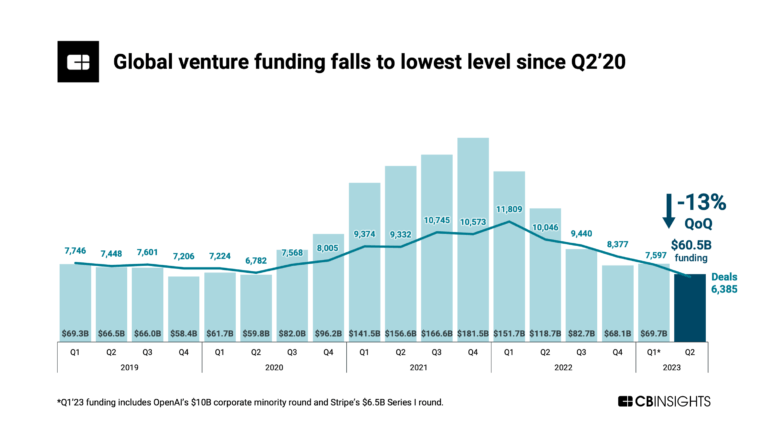

Yet, venture funding is still ongoing. According to CB Insights, global venture funding dropped 13% QoQ to hit $60.5B in Q2’23 — a three-year low.

What does this have to do with venture funding?

When the Federal Reserve bumped up the interest rates and it impacted the public market, a company that had a $12B valuation was revalued to a $3B valuation.

The public market correction was a strong signal to VCs funding private tech startups — because VCs take cues from public companies to inform their exit prices. For tech, many argue that the private market lags behind the public market roughly by 6 months.

Additionally, massive liquidity has exited the venture ecosystem - there's a lot less capital available to invest in tech startups. Over the last few years, liquidity in venture came from bigger funds that deployed faster and huge crossover investors from the public markets.

These crossover public market investors entered into the venture space with the expectation of an arbitrage opportunity: they often invest in the last sets of private rounds (pre-IPO); seeking a huge spread between public and private valuations, since they bid up all the private valuations using public companies as comparables.

And of course, most of those public companies’ valuations were inflated before the market correction.

Fast forward to Q2 2023, the public market is yet to fully recover to its peak as the market is monitoring the Federal Reserve’s action and this trickles down to VC funding as explained above.

VC Winter in Africa

Prior to the VC winter, most African startups saw an uptick in valuation from global investors who were making exploratory investments in Africa, who have now slowed down or stopped investing in Africa.

In the sci-fi series, Dune, survivors that cross the deadly desert follow safety advice: Walk without rhythm and you won't attract the worms.

Everyone is cautiously employing unpopular measures now.

In this VC winter, among many other things, funding could markedly be the difference between the perpetual continuity of a startup or its eventual death.

While many argue that some funds may not be active - there’s no accurate way to confirm this. On the flip side, most VCs are piling dry powder (i.e., cash reserves available for future investments) and deploying capital cautiously or reserving funds for their portfolio companies.

Perhaps VCs who are not investing are not fully deployed, have not completed raising their funds or are warehousing the deal — holding onto a potential investment opportunity for a certain period before committing to investing in it. Or their LPs are holding back. There’s no just precise way to confirm, either.

Meanwhile, despite the VC winter, in some verticals in Africa, funding continues but at a slower pace.

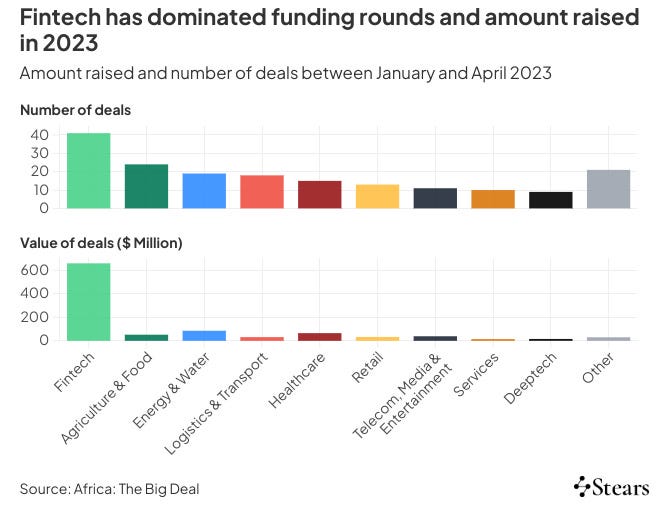

According to Big Deal’s data, fintech continues to dominate deal counts with 41 disclosed and undisclosed deals — which amounts to ~$650m.

Fintech startups raised 64% of total funding in Q1 2023 but only accounted for 23% of deals. This is an improvement over previous years, when fintech startups accounted for 35% and 55% of total funding in Q1 2022 and 2021, respectively. The lower share of deals in Q1 2023 can be attributed to the MNT-Halan deal ($400 million raised), which was a large funding round for a single fintech startup.

While VCs continue to monitor the Federal Reserve’s next move and the public market as it impacts private investments, nothing suggests that the pace of funding will accelerate any time soon.

Nevertheless, at Microtraction, we are actively investing in the best founders building amazing startups in Africa. We know that, like previous economic downturns, great companies (Google, PayPal, Airbnb, Stripe) were built like this current VC winter.

So, if you’re an early-stage startup, Microtraction is actively investing in tech startups in Africa — sector agnostic. Our standard deal is $100K for 7%. Apply for funding here.

Portfolio Spotlight

LemFi, formerly known as Lemonade Finance, has obtained an International Money Transfer Operator (IMTO) license from the Central Bank of Nigeria (CBN) through its subsidiary, RightCard Payment Services Limited.

Interesting Read:

Until next time,

Offiong ✌🏽